Knowing When To Hold Them, Knowing When To Fold Them

In any financial market the terms "Smart Money" and "Dumb Money" are vital terms to use, even in crypto. These terms do not condone a term to call someone stupid or smart, its all about who has access to analytics and does their homework on the trading markets before them.

Usually when your coined as being "Smart Money" you have access to a slew of resources and the ability to pull a team together to really figure out what a possible investment may or may not do for you. Most smart investors with these superhuman powers can judge most wisely and profit way higher than someone without access to these resources.

"Dumb Money" is coined a lot in crypto for very intense and purposeful reasons. Most investors in crypto on average are just small time traders with not too many resources past a few web searches to decide which portfolio best suits them. Due to this they tend to scrape change on the exchanges only due to the fact they are missing key pieces to the puzzle and not able to trade on higher margins due to that lack of knowledge. This isn't their fault but they are well known to the community as "Dumb Money" due to the usual outcome of losses or minimal gains they can tend to gather up.

How To Overcome The Shortcomings of Being Joe Schmo Investor

The moment you enter an exchange in crypto and you blindly choose a coin to purchase with no background knowledge on is truly a beginning disaster that's about to hit your outcome earnings even if you believe deeply its a wise choice. Sure you may get lucky and most of us do in crypto from time to time but the real earnings by not researching is going to allude you every day of the week.

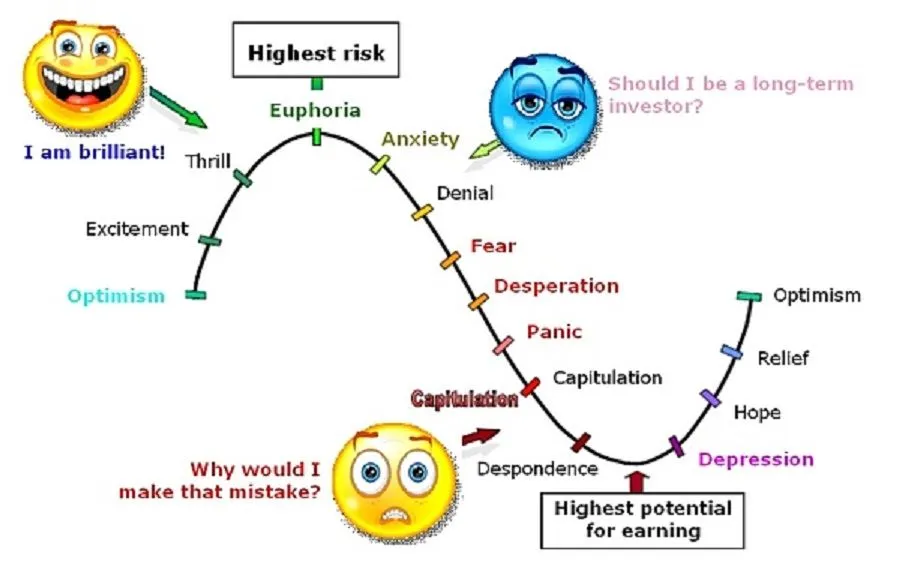

The concept of knowledge is power is thick in crypto markets. Due to a lot of dumb money running around blindly tossing those coins out there on a hope and a prayer, there is a bunch of smart money guys awaiting your every move to take you down to profit from your mistakes. These aren't apposing sides but usually feels that way to those who take losses, no its more two competing sides but one sticks it out long term and the other tends to lose out by shorting themselves out of emotional panic trading.

The key to trading is education, I am not meaning college but that is a huge plus but simply reading more up on what dynamics your investment presents to the whole of crypto, what unique features outshine the other coins, and most of all you gotta learn the tech behind these things as much as possible to really know what is validly put together withing the coins codebase system. Chart reading education is a plus as well but just blindly reading charts without a key concept of what is going on with a coin is drastic as well in my opinion.

Taking time before a trade to truly understand what you are getting yourself into is a huge course towards becoming smart money in crypto. Listening to trolls and getting countless trollbox tips as well is a key to your demise so I always tell everyone only listen to your guy and your informed mind when it comes to trading.

Dumb Money Hurts Crypto In The End

Cryptocurrency as a whole is very volatile and can really hurt poor traders with no tactics in the greater stage being played here. That volatility though could be rather stabilized if more people took the time to educate themselves on their trading techniques. So many dips hit us due to people running into panic trading mode and I suspect if people learned to long term like most Wall Streeters do, then that high and low game every hour on the hour would fine tune itself.

In the end I suspect until people grasp that getting emotional on the trading room floor is not benefiting their profits, we may keep on seeing the deep impacts of dumb money on the whole space. Its not anyone's fault, many are average day traders in this game right now but to really bring home the bacon its always benefited me personally when I am on a coin I trust and know a lot about. A coin that I can hold long term and wait out the markets. I am that guy usually that sits alone holding that bag when others run to the hills for the next best thing. Then when that next climb hits and everyone buys back in, I am taking your Bitcoins you just paid hard money to get back into when it reaches the top. That is because I don't fear losses ever, they happen and we live another day. Emotional trading is useless if you want to really trade. To overcome that you must know buying into something has risks but you can minimize that if you know better what market potential can bring and believe in that future for it.

I never like seeing anyone hurt by uneducated decisions so I hope everyone takes the time to read, makes money to set up their families well and enjoys the ride along the way. Because crypto my glorious blockchain pioneers is one hell of a ride to enjoy if you use it right!